First Bridge Lending focuses on delivering our customers with superior service and market-leading execution. Our multi-strategy debt platform provides our clients with a variety of lending options to meet the assortment of situations in today’s market. Some recent transactions are summarized below.

$225,000

35%

Residential

9 months

The borrower, the CFO of a real estate investment company, was looking to refinance one of their existing rental properties. First Bridge Lending provided a business‑purpose loan secured against the value of the rental asset. The proceeds will be used to renovate one of their investment properties. The borrower plans to pay off the loan with proceeds from one of their assets.

The loan amount totaled $225,000 at 35% LTV for a 9‑month term. First Bridge Lending originator Chris Carey facilitated this deal and helped the client secure financing for their investment property.

$3,750,000

69%

Residential

12 months

The repeat borrowers, husband and wife flippers, have completed more than 40 fix and flip projects on primarily high-end properties. First Bridge Lending provided financing for them to purchase their next flip property in Newport Harbor. The subject property was well maintained but needs interior and exterior updates. Purchased at $5,450,000 the borrowers plan to invest $1,000,000 in upgrades before listing to resell.

The loan amount totaled $3,750,000 at 69% LTPP for a 12-month term. First Bridge Lending originator Brian Haines facilitated this deal and helped the client secure funding for their fix and flip.

$3,000,000

47%

Owner Occupied Bridge

12 months

The borrower, part owner of a manufacturing company, was looking for a new residence that was suited for their family along with space for their parents to reside as well. First Bridge Lending provided an owner‑occupied bridge secured against the borrower’s current residence, their parents residence and their new residence they were purchasing. The equity in their current residences was able to be used to purchase the new home - an exceptional 7,500 sq ft house located on a 5-acre property, featuring an ADU on the property. The two properties in Murrieta, CA will be sold to payoff the loan.

The loan amount totaled $3,000,000 at 47% LTV for a 12‑month term. First Bridge Lending originator Brian Haines facilitated this deal and helped the client secure funding for their new residence.

$1,500,000

25%

Owner Occupied Bridge

12 months

The borrower, the CEO of a life science firm, was looking to secure a new primary residence in La Jolla Shores. First Bridge Lending provided a stand-alone owner‑occupied bridge loan structured as a cash‑out refinance on their existing primary residence, enabling the borrower to purchase their new home—an exceptional 3,000 sq ft residence just steps from the beachfront, featuring 4 bedrooms and 4.5 bathrooms.

The loan amount totaled $1,500,000 at 25% LTV for a 12‑month term. First Bridge Lending originator Brian Haines facilitated this deal and helped the client secure funding for their new coastal residence.

$617,500

65%

Owner Occupied Bridge

12 months

The borrowers were looking to relocate from Chino Hills to Temecula. First Bridge Lending provided stand-alone bridge loan on their current residence. The equity in their current residence was used to purchase of their next home in Temecula. Once they move into their new residence, they will list their current residence in Chino Hills, CA for sale and use the proceeds to pay off the loan.

The loan amount totaled $617,500 at 65% LTV for a 12‑month term. The loan originator Sofia Nadjibi helped the clients secure financing to buy their new home.

$966,000

70%

Residential

12 months

The borrower, the owner of an apparel company and an experienced real estate investor, was looking to purchase a property to renovate and re‑sell for profit. They planned to acquire the home for $1,380,000 and invest approximately $250,000 into renovations before listing it for around $2,200,000. First Bridge Lending provided a loan enabling them to fund both the purchase their next fix and flip property.

The loan amount totaled $966,000 at 70% LTPP for a 12‑month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure financing for their fix‑and‑flip project.

$750,000

46%

12 months

The borrower worked in policy communications for a tech company and them and their spouse were looking to relocate from Oakland to Walnut Creek. First Bridge Lending provided a stand-alone owner occupied bridge loan on their new Walnut Creek 2,031 sq ft 4-bedroom 3-bathroom residence they were purchasing. The Oakland home will be put on the market once they are settled into their new Walnut Creek home. They will use the proceeds of the sale to pay off the loan.

The loan amount totaled $750,000 at 46% LTPP for a 12-month term. First Bridge Lending originator Brian Haines facilitated this deal and helped the client secure funding to purchase their new home.

$598,000

54%

Owner Occupied Bridge

12 months

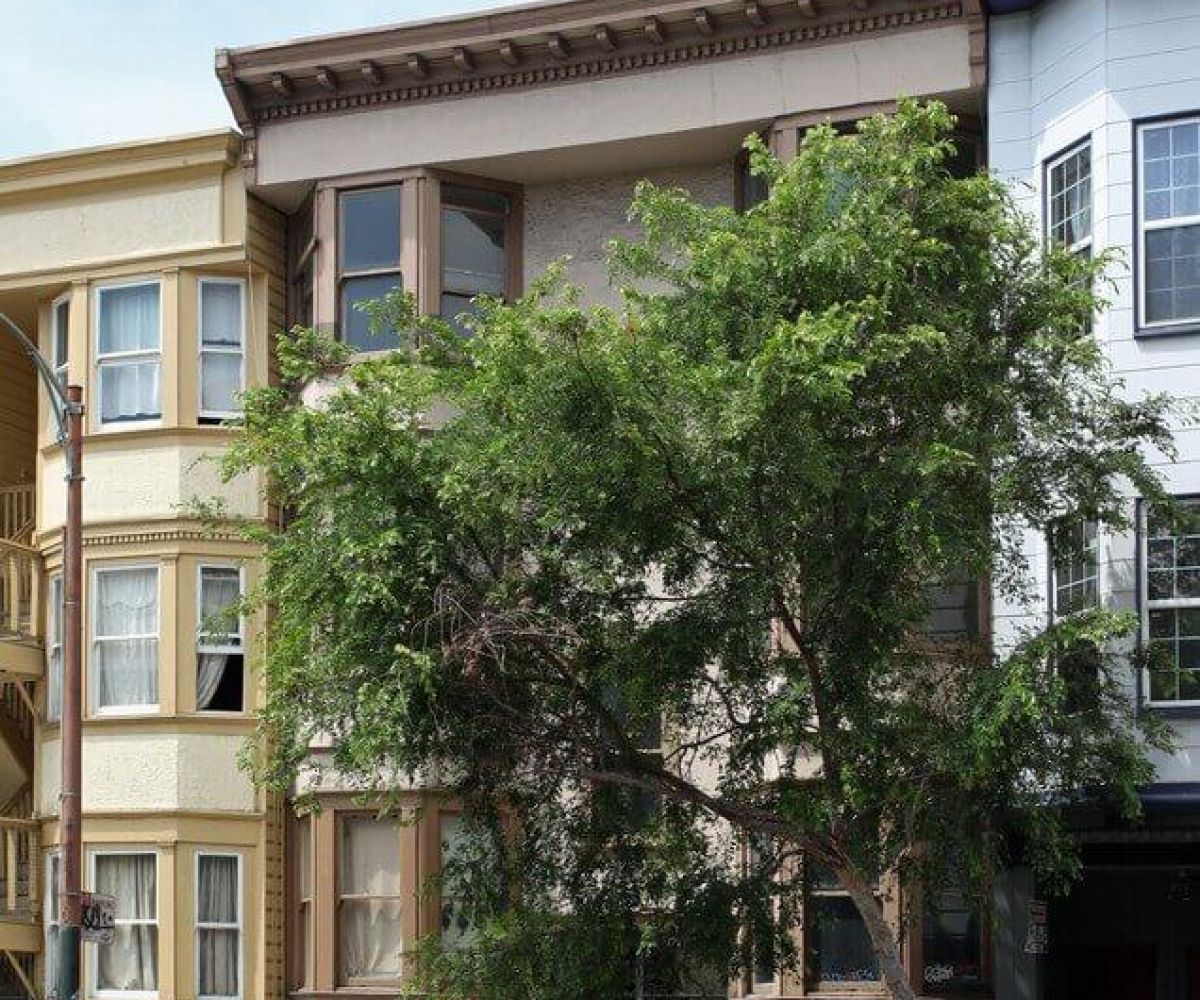

The retired borrowers were looking to purchase a new home in Oregan. First Bridge Lending provided an owner occupied bridge loan, which allowed the borrower to access the equity in their current residence in San Francisco, CA for the down payment on their new home out of state. They plan to list their current San Francisco home for $1,100,000. Once sold they will use the proceeds to pay off the loan.

The loan amount totaled $598,000 at 54% LTV for a 12-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure funding to purchase their new home.

$256,000

26%

Residential

12 months

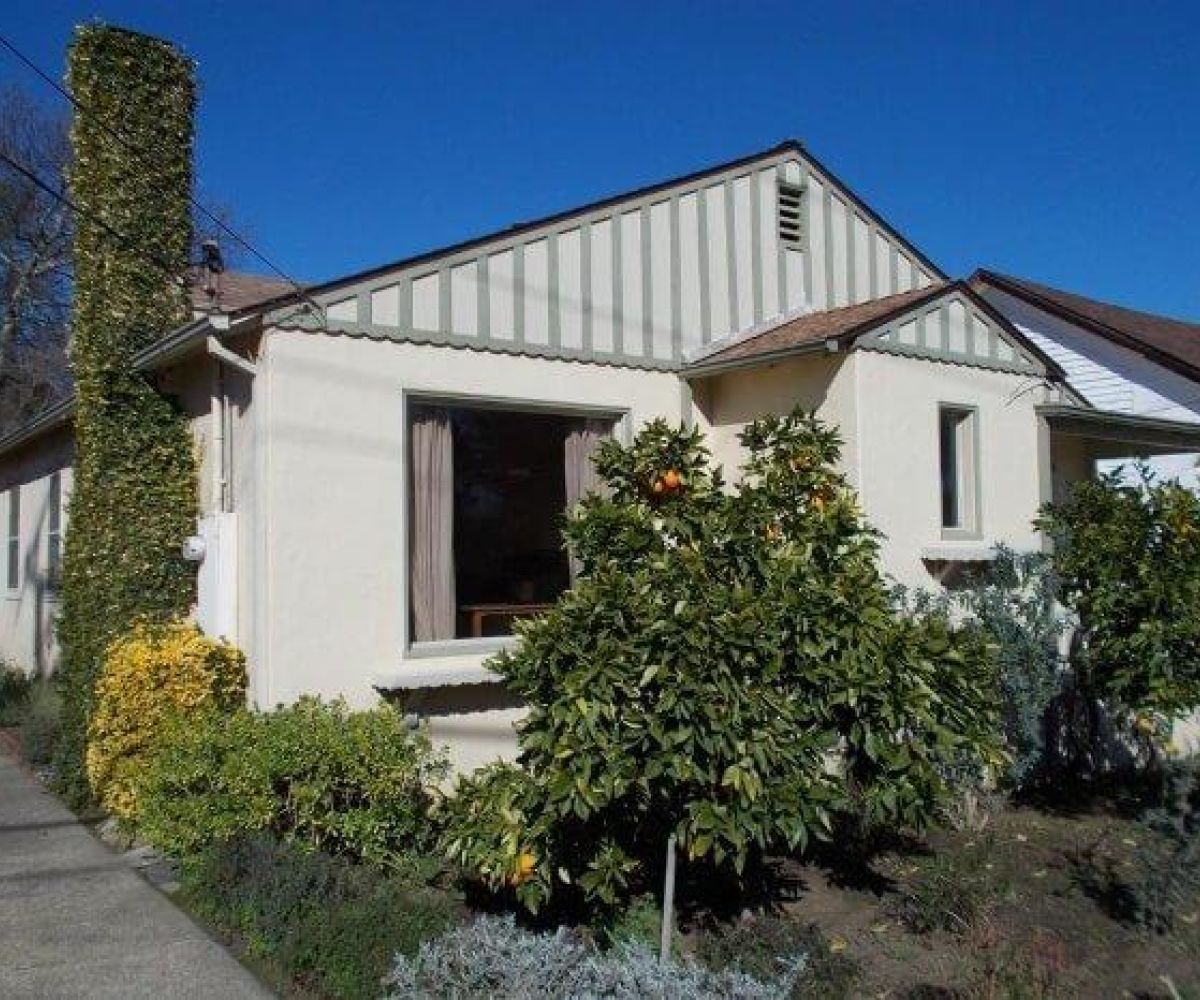

The borrower works in the restaurant industry. They came to First Bridge Lending to finance the purchase of a rental property in Sebastopol, CA. The property is a single-story ranch style 5 bedrooms and 3 bathrooms located on 1.5 acres in a desirable area of town close to amenities. It is in good condition but could use some updating. The property also has an additional detached unit.

The loan amount totaled $256,000 at 26% LTPP for a 12-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure funding to purchase their next investment property.

$321,750

65%

Residential

12 months

The borrowers are real estate investors who came to First Bridge Lending to finance the acquisition of their next rental property. The subject property is 1,269 sq ft SFR with 3-bedrooms and 2-bathrooms located in a good neighborhood in Citrus Heights, CA. The borrowers plan to lease the property for $2,250/month and refinance with a conventional lender.

The loan amount totaled $321,750 at 65% LTPP for a 12-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the clients secure funding for their SFR purchase.

$1,500,000

49%

Owner Occupied Bridge

12 months

The borrowers are retired on a fixed income looking to relocate to a new area in CA. First Bridge Lending provided an owner occupied bridge loan, which allowed the borrower to access the equity in their current 3-bedroom and 3.5-bathroom residence in Novato, CA and their new 3-bedroom and 2.5-bathroom residence in Lincoln, CA. The Novato, CA residence will list for $2,195,000 and will pay off the loan once it sells.

The loan amount totaled $1,500,000 at 49% LTV for a 12-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure financing for their new home.

$6,000,000

60%

Commercial

24 months

The borrower is a real estate investor with experience in commercial development in Southern California. They came to First Bridge Lending to secure financing for their next commercial purchase. The mixed-use property is a corner lot in downtown La Jolla, CA comprised of 15,560 sq ft of ground floor retail space and 11,166 sq ft of second floor office and retail space.

The loan amount totaled $6,000,000 at 60% LTPP for a 24-month term. First Bridge Lending originator Brian Haines facilitated this deal and helped the client secure funding for their commercial property purchase.

$300,000

14%

Owner Occupied Bridge

12 months

Client was interested in purchasing a new family residence for $2,100,000. The borrower’s current residence was listed for sale at $3.4MM but had not yet sold. Instead of waiting for the home to sell, the client was interested in moving quickly on a new property. The client was a strong candidate because of his existing real estate. His net worth was also listed at $30MM and his real estate properties generated in excess of $1MM annually.

To create the down payment, the client was able to liquidate some of his stock. The loan was drafted with the agreement that the client would repay the loan with either the sale of the aforementioned $3.4MM property or would liquidate more of his stock in January 2019. This enabled the client to quickly move on an ideal residential property without first selling his existing home. He also did not have to come up with the purchase price entirely through liquidated stock with the loan agreement.

The property itself was a large single family home with 3 beds, 2 full baths, and 2,216 square feet. Located on an expansive lot with 8.23 acres, the property was the perfect country residence. The property was also set up for horses and included a custom 4-stall barn as well as other amenities. The client was interested in purchasing the property as a family residence.

First Bridge Lending agent Louis Bardis expedited and processed the loan for the client. When purchasing a new residence, trust First Bridge Lending to handle your loan regardless of your current income parameters. First Bridge Lending is a private lender and can work with you directly to help you purchase new property.

$1,292,000

72%

Residential

9 months

This borrower was brought to First Bridge Lending by a broker we do business with on a regular basis. This particular property was difficult to lend on because it was mid-stream construction. Most conventional lenders—even private money lenders—wouldn’t know how to lend on this property because of issues with mechanic’s liens.

The buyer was a local realtor looking to put $350,000 into the property and sell it in excess of $2.5M. We were able to communicate directly with the title companies and provide exactly what they need, so we were confident lending on a mid-stream construction project.

The LTV was 72% and the loan amount was $1,292,000. We also arranged a second deed of trust, or gap financing, at $300,000 for the borrower to close escrow with less money down. First Bridge Lending agent Louis Bardis accelerated the loan process to help the borrower quickly receive their renovation funds.

$291,000

70%

Residential

6 months

This 3-bedroom, 2-bath, 1,100-square-foot property was a single-family home in poor condition that the borrower wanted to flip for profit. The borrower, a repeat client, directly contacted First Bridge Lending for assistance, since a conventional lender wouldn’t be likely to make a loan on the property. With the borrower’s high credit score and house-flipping experience, as well as our knowledge of the local San Jose market, we were able to fund a private loan and close the deal within a week.

The loan amount was $291,000 with an LTV of 70%. A First Bridge Lending originator assisted the client with the property loan. The loan for the property closed within a week and the seller did not list the property on the open market.

$1,140,750

59%

Residential

9 months

The borrower was referred to First Bridge Lending by a mortgage broker we work with on a regular basis. They were in a bind and needed cash to finish renovations on the property in order to lease the units for a higher rent. The borrower had a high credit score and high monthly salary, so we were able to accommodate their request with confidence and fund the loan in a timely manner. We net funded 6 months of payments, plus an additional draw to call at a later time after we could see progress on the property.

The loan amount totaled more than $1.1M at 59% LTV for a 9-month term, as well as $100,000 as an additional draw. First Bridge Lending loan originator Louis Bardis facilitated this deal and helped the client secure funding in time to refinance the property, as well as complete construction work and renovations.

$775,000

55%

Residential

12 months

The borrower made an all-cash property purchase and was looking to make an offer on the neighboring property in order to complete permitting and sell both parcels to a developer. First Bridge Lending placed a single loan across both properties, allowing the borrower to cover 100% of the new purchase with the loan proceeds.

The loan amount totaled $775,000 at 55% LTV for a 12-month term. A First Bridge Lending originator facilitated this deal and helped the client secure both properties as rentals while they begin the permitting and planning process and marketing of the land to developers.

$345,000

71%

Residential

9 months

The borrower was looking to purchase an investment property in need of heavy renovations in order to flip the property for resale. They were working with a different lender, and the original lender did not have the capital required for the borrower to close on the property. The borrower needed to close in 72 hours to secure the property, and a wholesaler referred them to First Bridge Lending. Loan documents were in escrow the next day and we were prepared to fund within 1 business day.

The loan amount totaled $345,000 at 70% LTV for a 9-month term. A First Bridge Lending originator facilitated this deal and helped the client secure funding for their property purchase and renovations.

$1,275,000

62%

Owner Occupied Bridge

12 months

The borrowers were empty-nesters who found their dream home, but needed to close on the purchase before they had an opportunity to sell their current home. First Bridge Lending structured a bridge loan that allowed the borrower to draw from the equity in their existing property to fully cover the purchase price of their new home. The borrowers were able to move into their new home and prepare their original home for sale at their convenience. After that sale, they will comfortably qualify for conventional financing.

The loan amount totaled $1,275,000 at 65% LTV for a 12-month term. A First Bridge Lending originator facilitated this deal and helped the client secure funding for their new home.

$247,000

70%

Residential

9 months

The borrower came to First Bridge Lending for assistance with a flip loan after working with another lender who was unable to perform. The wholesaler referred the borrower, and their documents were in escrow the next day and the loan was at a lower price than the original lender quoted or could deliver. We were able to fund the client’s loan in order to purchase a property to renovate and flip.

The loan amount totaled $345,000 at 70% LTV for a 9-month term. A First Bridge Lending originator facilitated this deal and helped the client secure funding for their property purchase and renovations.

$1,800,000

60%

Owner Occupied Bridge

12 months

The borrower, an experienced real estate broker and investor, was purchasing a property in West Hollywood and cross-collateralizing their primary residence in Atherton. They needed to close escrow on the new property in a competitive bidding situation, and First Bridge Lending came in to fund the loan quickly in order to secure the property.

The loan amount totaled $1,800,000 at 60% LTV for a 12-month term. First Bridge Lending agent Louis Bardis facilitated this deal and helped the client close escrow on their new home nearly $100,000 below other buyers’ offers by funding the loan in 10 days.

$750,000

54%

Residential

12 months

This property is located near Granite Bay in a neighborhood with high-end construction. The borrower, an experienced general contractor, purchased the land in 2017 for $350,000 and has invested an additional $610,000 into the property. The project was partially complete when the borrower came to First Bridge Lending to pay off the existing loan on the land and to complete the house. We gave the borrower $515,000 up front to pay off the land and additional draws totaling $235,000 for construction to finish the property. The borrower plans to complete the project and sell for $2,000,000 or more.

The loan amount totaled $750,000 at 49% LTC for a 12-month term. First Bridge Lending loan originator Louis Bardis facilitated this deal and helped the client secure funding for completion of their development project.

$335,000

34%

Residential

6 months

The borrower for this property was part of a three-party trust, and he financed his portion with a First Bridge Lending loan. We were able to work with the trustees and create a structure that allowed them to move forward with the deal and close as an all-cash purchase. Because we were able to close within two days, the investors were able to purchase the property quickly and below market value.

The loan amount totaled $335,000 at 34% LTV for a 6-month term. A First Bridge Lending originator facilitated this deal and helped the client secure funding for an all-cash purchase of the new property.

$4,400,000

55%

Commercial

6 months

The borrower purchased a 23-unit multi-family investment property in 1994 and was looking to cash out in order to use the proceeds for a development deal and to buy out an equity partner. With a cash-out refinance loan from First Bridge Lending, the borrower received the required short-term capital to move forward with their development project and restructure their entity ownership.

The loan amount totaled $4,400,000 at 55% LTV for a 6-month term. A First Bridge Lending loan originator facilitated this deal and helped the client secure capital for their development project with no cash out of pocket.

$1,900,000

50%

Residential

12 months

This borrower is an experienced builder who came to First Bridge Lending looking to complete their building project. They purchased the property with 2 single-family homes for $1.25M, scrapped the existing homes, and have invested an additional $1.2M in constructing 3 new single-family homes on 3 separate parcels. The borrower plans to complete these homes and sell each for $1.4M.

We were able to provide $400,000 up front, as well as $450,000 across a few draws to finish construction. We also assisted the borrower with accounting work to verify payment to subcontractors due to mechanic’s liens.

The loan amount totaled $1,900,000 at 50% LTV for a 12-month term. First Bridge Lending agent Chris Carey facilitated this deal and helped the client secure funding to complete construction on all 3 homes.

$1,050,000

35%

Owner Occupied Bridge

12 months

The borrower was looking to purchase a condo in Emeryville using their current primary residence in San Francisco as collateral. First Bridge Lending was able to fund 100% of the purchase price of the condo, which allowed the borrower to access all the equity from their current home for the purchase the new residence. We funded the loan in about 10 days, and the sale of the original property will pay off the loan in full.

The loan amount totaled $1,050,000 at 35% LTV for a 12-month term. A First Bridge Lending originator facilitated this deal and helped the client secure funding for their new primary residence.

$448,000

70%

Residential

12 months

The borrower is a full-time investor who has flipped 8 homes in Sonoma County since 2011. They came to First Bridge Lending when another hard money lender couldn’t perform in time for the borrower to close on the new property, which was in pre-foreclosure. We helped the borrower close the property within 7 days and save the deal.

The loan amount totaled $448,000 at 70% LTV for a 12-month term. First Bridge Lending agent Louis Bardis facilitated this deal and helped the client secure funding for renovations on the new property.

$654,500

70%

Residential

6 months

This repeat borrower made an aggressive offer on a property and needed to close quickly, so they came to First Bridge Lending for financing on a fix and flip loan. The borrower has flipped more than 10 homes in the last 36 months, and they plan to invest $90,000 in remodeling for a new sale price over $1,200,000.

The loan amount totaled $654,500 at 70% LTV for a 6-month term. First Bridge Lending agent Louis Bardis facilitated this deal and helped the client close in less than 7 days to save the deal.

$780,000

41%

Residential

9 months

The borrower has been flipping homes for 3 years and has a full-time crew. They purchased this vacant property to build an addition and used another property as collateral. With the help of First Bridge Lending, they were able to make a non-contingent purchase using all borrowed funds.

The loan amount totaled $780,000 at 41% LTV for a 9-month term. A First Bridge Lending originator facilitated this deal and helped the client secure funding for their rental purchase.

$130,000

70%

Residential

6 months

The borrower was a first-time house flipper, and they needed an acquisition loan to close on a vacant property they intend to flip. First Bridge Lending was able to structure the loan so that the borrower needed less than $30,000 to close on a $185,000 purchase price.

The loan amount totaled $130,000 at 70% LTPP for a 7-month term, with a second DOT of $267,677 at 15% LTPP. A First Bridge Lending originator facilitated this deal and helped the client secure funding to flip their vacant property and get it back on the market.

$1,250,000

65%

Residential

6 months

The borrower, a buy-and-hold investor, was looking to purchase a new property to rent. They qualified for a cross-collateralized loan that covered 150% of the purchase price of the new property, which allowed them to use the cash out for a downpayment on an additional purchase.

The loan amount totaled $1,250,000 at 65% LTV of both properties for a 6-month term. A First Bridge Lending originator facilitated this deal and helped the client secure funding for their new property acquisitions.

$600,000

68%

Residential

6 months

The borrower is a real estate broker who has flipped three properties in the last two years. They came to First Bridge Lending for a loan to remodel the kitchen and bathrooms of this property, as well as complete some minor cosmetic upgrades. The property was purchased below market value for $885,000, and the borrower plans to list it for $1.3M.

The loan amount totaled $600,000 at 68% LTV for a 6-month term. First Bridge Lending agent Louis Bardis facilitated this deal and helped the client secure funding within 10 days to use toward remodeling expenses on their fix and flip property.

$800,000

25%

Commercial

12 months

The borrower is a full-time real estate investor with 20 years’ experience who was looking for a loan on their commercial retail property in order to pay property taxes on other assets in their portfolio. This retail location is in the main commercial area of San Rafael with a current lease by a beauty shop. The borrower purchased the property in December 2017 for $3,225,000.

The loan amount totaled $800,000 with an additional $100,000 advance at 25% LTV for a 12–month term. A First Bridge Lending originator facilitated this deal and helped the client close within a week to secure funding for property tax payments on other properties in their portfolio.

$1,140,000

51%

Residential

6 months

The borrower wanted to purchase a single family residence with an adjacent buildable lot and came to First Bridge Lending to obtain a single loan for both properties. They wanted to remodel the single family home and obtain permits to build on the vacant lot. Since most lenders are not able to lend on bare land, First Bridge was able to use a cross-collateral loan to cover both properties and fund the loan in one week.

The loan amount totaled $1,140,000 at 51% combined LTV for a 6-month term. A First Bridge Lending originator facilitated this deal and helped the client secure funding for a bare land and flip property purchase.

$515,000

60%

Owner Occupied Bridge

12 months

Retired borrowers had found their next primary residence, but did not have the down-payment funds to execute the purchase. Their broker turned to Christopher Carey, who structured a bridge loan that used the existing equity in their current residence to purchase the new residence. The borrower and broker were thrilled with the simplicity and reliability that the First Bridge Lending team provided, and they were able to make their purchase offer with confidence. The loan closed, with no problems or delays, in less than 10 days. The buyers have already moved into their dream home and are prepping their old home for sale.

$1,050,000

48%

Commercial

9 months

This experienced commercial investor, who has worked with Christopher Carey for more than 20 years, was able to negotiate a great deal on their purchase due to the speed and certainty of funding that First Bridge Lending delivers. The buyer saved more than $300,000 because the seller preferred their 7-day close offer. The borrower was thrilled with the performance, simplicity, and reliability that First Bridge delivered and is looking to repeat the process on his next acquisition, using First Bridge as their reliable capital partner to grow their business.

$1,993,000

72%

Residential

9 months

This experienced flipper was trying to obtain bank funding, but it was taking too long. The seller was ready to take a back-up offer and keep the significant earnest money deposit. The buyer turned to Christopher Carey and the team at First Bridge Lending, who were able to provide loan documents that were ready to sign that same day. First Bridge funded the loan in less than 48 hours, saving the deal and the borrower’s deposit.

$280,000

63%

Residential

12 months

This inexperienced borrower owned their home free and clear and was looking to purchase their first investment property to flip and re-sell. They had contacts that would help with the flip, but they didn’t have enough liquidity to purchase the property. Their broker turned to a First Bridge Lending originator who structured a cross-collateral business-purpose loan to help the borrower purchase their first investment property.

$5,000,000

31%

Commercial

12 months

The borrower is an experienced investor who has been a full-time landlord for more than 25 years, and they were seeking cash for business expenses and capital improvements. They purchased the commercial property in 2008 for $12.5M, then leased to the current tenant, who recently vacated. The property is free and clear, with the exception of a cross-collateral property that is being refinanced.

First Bridge Lending provided an initial $3M funding with a first draw of $1M and subsequent draws of $250,000 each to provide refinance shortfall funds as needed. First Bridge Lending agent Christopher Carey facilitated this deal at 31% LTV for a 12-month term.

$1,300,000

43%

Commercial

12 months

The borrower was an experienced landlord seeking cash for both business use and investments. They purchased the property—a retail strip center and parking lot—in 1988 for $1.27M. Proceeds from the loan will cure cash-flow problems due to recent tenant issues, as well as provide capital for investments.

The loan amount totaled $1,300,000 at 43% LTV for a 12-month term. First Bridge Lending agent Christopher Carey facilitated this deal and helped the client secure funding.

$603,000

58%

Residential

6 months

The borrower, who has flipped 6 properties in the last 24 months, came to First Bridge Lending for a cross-collateral loan on a current rental property in order to purchase a new property with the intention of remodeling and reselling. They have been doing business with First Bridge since 2013. The borrower is purchasing the flip property for $412,500 and investing $30,000 in remodeling, and they plan to sell it for $525,000. First Bridge was able to provide a cross-collateral loan with a rental property the borrower purchased in 2008.

The loan amount totaled $603,000 at 58% LTV for a 6-month term. First Bridge Lending agent Louis Bardis facilitated this deal and helped the client secure funding for their new flip property purchase in order to remodel and sell for a profit.

$850,000

50%

Commercial

9 months

The borrower wanted to purchase a property in the hub of a commercial area in San Francisco as a rental property. They came to First Bridge Lending for funding in order to complete a reverse 1031 exchange as part of the purchase. The borrower plans to complete repairs, refinance the property, and keep it long-term as a rental property.

The loan amount totaled $850,000 at 50% LTPP for a 9-month term. A First Bridge Lending originator facilitated this deal and helped the client secure funding for their rental purchase.

$680,000

50%

Owner Occupied Bridge

12 months

The borrower wanted to purchase a new residence in a desirable Pebble Beach location. They came to First Bridge Lending for an owner occupied bridge loan, which allowed them to access the equity in their current residence in order to purchase the new property. They will sell their current home to pay off the loan.

The loan amount totaled $680,000 at 50% LTPP for a 12-month term. A First Bridge Lending originator facilitated this deal and helped the client secure funding for their new home purchase.

$1,085,000

70%

Residential

12 months

The borrower is an experienced builder who is motivated to flip properties full-time. This is their first solo flip, after having worked for flippers for 20 years, and they came to First Bridge Lending for a loan in order to purchase a corner-lot property on a quiet street. The finished asset will be 2,100 square feet and the borrower expects to sell for $2.75M. The seed money from the flip will fund future flip projects.

The loan amount totaled $1,085,000 at 70% LTPP for a 12-month term. First Bridge Lending agent Christopher Carey facilitated this deal and helped the client secure funding for their SFR flip purchase.

$700,000

18%

Residential

12 months

The borrower is an experienced investor and full-time developer. They purchased the parcel on a busy street close to Santa Clara University for $1,300,000 and have invested $2,500,000 in building 3 new single-family homes on a subdivided lot. The homes are free and clear, and the borrower came to First Bridge Lending for financing to complete landscaping and utilities before reselling for an estimated $5.6MM total.

The loan amount totaled $700,000 at 16% LTV for a 12-month term. First Bridge Lending agent Louis Bardis facilitated this deal and helped the client secure funding for final landscaping and utilities on new homes before reselling for a profit.

$2,000,000

38%

Residential

12 months

The borrower is an experienced developer who has completed major renovations on 4 Marin County homes in the last 24 months. They purchased this 1.23-acre parcel in a premium neighborhood with views of San Francisco, CA and the Golden Gate Bridge. They have secured permits and entitlements for a 12,500 SF home with a boat dock and waterfront casita.

The loan amount totaled $2,000,000 at 38% LTV for a 12-month term. First Bridge Lending agent Louis Bardis facilitated this deal and helped the client secure funding to pay off a matured loan before obtaining construction financing.

$300,000

57%

Residential

12 months

The borrower is a full-time investor who purchased this property in 2014 for $520,000. They recently evicted the tenants and will be completing a remodel of all 4 units before re-leasing for an estimated gross rent of $8,000/month. They came to First Bridge Lending for a line of credit loan with initial funding of $67,000 and additional draws in $25,000 increments.

The loan amount totaled $300,000 at 57% LTPP for a 12-month term. First Bridge Lending agent Louis Bardis facilitated this deal and helped the client secure funding for their remodel and re-lease all 4 units.

$320,000

52%

Owner Occupied Bridge

12 months

Upon retirement, the borrower was looking to downsize by selling their home in Redwood City and purchasing a smaller home in Santa Rosa. With an owner occupied bridge loan from First Bridge Lending, they were able to purchase a home in a premium condominium community for $610,000, and the proceeds from the sale of their Redwood City residence will pay off the loan.

The loan amount totaled $320,000 at 52% LTPP for a 12-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure funding for their new residence purchase.

$500,000

69%

Residential

6 months

The borrower is a full-time home flipper who has completed 16 high-end SFRs in the Bay Area. They needed financing for an SFR in foreclosure with hostile tenants that would not allow for an interior inspection. First Bridge Lending provided financing with just a drive-by inspection and the loan closed in 3 days. The borrower purchased the property for $724,500 and is completing $55,000 in renovations with the intent to sell for $850,000.

The loan amount totaled $500,000 at 69% LTV for a 6-month term. A First Bridge Lending originator facilitated this deal and helped the client secure funding in 3 days to finance their flip.

$777,000

70%

Residential

9 months

The borrower has flipped 11 properties in the last 4 years and came to First Bridge Lending for financing on their latest purchase. The property is located in Fremont in a highly acclaimed school district, and it only needed interior updates before listing. The borrower expects to sell the property for $1,450,000.

The loan amount totaled $777,000 at 70% LTPP for a 9-month term. A First Bridge Lending originator facilitated this deal and helped the client secure funding for their flip property purchase.

$1,100,000

65%

Residential

9 months

The borrower is a full-time developer who wanted to pay off a maturing construction loan. Upon completion of the construction, the borrower came to First Bridge Lending to refinance their loan while listing the property on the market. The property is a newly built 3-story SFR with views of San Francisco, the Golden Gate Bridge, and the Bay Bridge.

The loan amount totaled $1,100,000 at 65% LTV for a 9-month term. First Bridge Lending originator Christopher Carey facilitated this deal and helped the client secure funding for their property.

$2,050,000

68%

Residential

9 months

The borrower is a full-time experienced contractor and landlord who wanted to purchase a SFR in San Mateo, which required $350,000 for renovations. They own 2 free and clear Bay Area rentals worth $1,800,000, which allowed First Bridge Lending to provide a cross-collateral loan using the equity in their San Francisco rental property, valued at $1,250,000. The initial funding totaled $1,750,000 at 63% LTV, and the borrower can request the remaining $300,000 as work is completed in $100,000-increment draws. Once the renovations are finished, the borrower expects to sell for $2,400,000.

The loan amount totaled $2,050,000 at 68% LTV with initial funding of $1,750,000.00 at 58% LTV for a 9-month term. First Bridge Lending originator Christopher Carey facilitated this cross-collateral deal and helped the client secure funding for their flip property.

$2,112,500

65%

Residential

6 months

The borrowers are experienced landlords with Bay Area rental properties, who were seeking financing with First Bridge Lending to expand their family holdings. FBL was able to fund the purchase of the SFR in 48 hours when a bank loan was too slow to close the deal. The borrowers already had a tenant lined up with expected rent of $10,000/month, and they plan to refinance with a conventional bank loan within a few months.

The loan amount totaled $2,112,500 at 65% LTPP for a 6-month term. First Bridge Lending agent originator Christopher Carey, facilitated this deal and helped the client secure funding for their SFR purchase.

$1,060,000

65%

Residential

6 months

The borrower is a new investor who wanted to flip their now-vacant former residence. They purchased the property for $1,470,000 in 2014 and have spent $160,000 on renovations. First Bridge Lending provided a loan that would allow the borrower to complete renovations to sell the finished property. The borrower expects to sell the SFR for at least $2,000,000.

The loan amount totaled $1,060,000 at 65% LTV for a 6-month term. First Bridge Lending originator Christopher Carey facilitated this deal and helped the client secure funding for their flip property.

$5,520,400

60%

Residential

12 months

The borrower is an experienced investor who came to First Bridge Lending for financing on a new 6-property infill subdivision construction project. They have two additional subdivisions in process as well. First Bridge Lending provided an initial funding of $3,239,000 across all 6 properties, with monthly draws available from the lender holdback of $2,281,400. The borrower can call for a draw based on work completed.

The loan amount totaled $5,520,400 at 60% LTC, with initial funding of $3,239,000 at 54% initial LTC, for a 12-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure funding for their new subdivision construction.

$322,000

70%

Residential

6 months

The borrower is an experienced home flipper who has flipped 3 properties in the last 4 years. They came to First Bridge Lending for financing on their new flip property purchase, a single-level residential SFR in San Leandro, purchased at $450,000. The property was dated but in good condition; renovations were expected to cost $100,000 and the borrower expects to sell the finished property for $700,000.

The loan amount totaled $322,000 at 70% LTPP for a 6-month term. First Bridge Lending originator Christopher Carey facilitated this deal and helped the client secure funding for their latest flip property purchase.

$175,000

47%

Residential

6 months

The borrowers, husband and wife, are an experienced home flipper team who typically purchase properties with all cash. They came to First Bridge Lending for financing for their latest property, a 4-bedroom, 2-bathroom SFR in Ontario, CA. They plan to remodel the kitchen and bathrooms, install new flooring throughout the house, and landscape both the front and back yards. The borrowers purchased the property for $375,000 and intend to list the finished property for $525,000.

The loan amount totaled $175,000 at 47% LTPP for a 6-month term. A First Bridge Lending originator facilitated this deal and helped the client secure funding for their flip property.

$550,000

70%

Residential

6 months

The borrower has flipped 4 properties in the last 5 years and came to First Bridge Lending for financing to purchase a two-level SFR in Castro Valley. Renovations are expected to cost $80,000, including kitchen, bathrooms, floors, painting, and landscaping, and the borrower expects to sell the property for $980,000.

The loan amount totaled $550,000 at 70% LTPP for a 6-month term. First Bridge Lending originator Christopher Carey facilitated this deal and helped the client secure funding for their latest flip property.

$426,000

71%

Residential

9 months

The borrower owns 5 properties in total, 3 of them free and clear, and came to First Bridge Lending for financing to purchase a new rental property. First Bridge Lending provided funding for the borrower to secure the purchase and complete necessary renovations on the dated property before refinancing with a conventional loan.

The loan amount totaled $426,000 at 71% LTPP for a 9-month term. A First Bridge Lending originator facilitated this deal and helped the client secure funding to purchase their new rental.

$1,300,000

62%

Owner Occupied Bridge

12 months

The borrower wanted to downsize to Carmel upon retirement, and they came to First Bridge Lending for an owner occupied bridge loan. They were able to purchase the Carmel home for $1,440,000 before they put their current home in Mountain View on the market. First Bridge Lending structured the loan using equity from their current residence and their new home, while allowing the borrowers to keep their conventional mortgage in place on the Mountain View property until it sold. Their new property is a renovated European-style cottage in a desirable area by the sea.

The loan amount totaled $1,300,000 at 62% LTV for a 12-month term. A First Bridge Lending originator facilitated this deal and helped the client secure funding to purchase their new residence.

$726,000

60%

Residential

6 months

The borrowers are a married couple in the food industry seeking their first investment property. First Bridge Lending provided financing to purchase the 4-bedroom 3-bathroom SFR in Pleasanton, CA.

The borrowers purchased the property for $1,210,000 and will rent the SFR for $4,800/month. The loan amount totaled $726,000 at 60% LTPP for a 6-month term. First Bridge Lending originator Christopher Carey facilitated this deal and helped the client secure funding for their SFR purchase.

$99,000

60%

Residential

12 months

The borrower is a full-time investor who has flipped 20 houses in the last 4 years and owns 8 rentals free and clear. They came to First Bridge Lending for financing to secure their next fix and flip investment property. The borrower purchased the property for $165,000 and they intend to invest $30,000 before they re-sell for $245,000.

The loan amount totaled $99,000 at 60% LTPP for a 12-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure funding for their latest flip property.

$440,000

55%

Residential

12 months

The borrower is a project manager for a construction firm who was looking to purchase their first real estate property to rent. They came to First Bridge Lending for financing on the 3-bedroom 2-bathroom SFR. The borrower purchased the property for $800,000 and expects to rent the SFR for $3,500/month.

The loan amount totaled $440,000 at 55% LTPP for a 12-month term. First Bridge Lending originator Christopher Carey facilitated this deal and helped the client secure funding for their first rental property.

$175,000

70%

Residential

12 months

The borrower is a full-time investor who has flipped houses with a partner for 12 years. They came to First Bridge Lending for financing to secure their next fix and flip investment property. The borrower purchased the property for $249,900, they intend to invest $30,000, and list the property for $335,000 once completed.

The loan amount totaled $175,000 at 70% LTPP for a 12-month term. A First Bridge Lending originator facilitated this deal and helped the client secure funding for their latest flip property.

$700,000

47%

Residential

12 month

The borrower is a full-time contractor and real estate investor who has renovated over 20 homes in San Francisco in the last 4 years. First Bridge Lending refinanced their Bernal Heights SFR, with 3 private balconies and roof deck, allowing the borrower to pay off their private investor.

The loan amount totaled $700,000 at 47% LTV for a 12-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure funding for their latest flip property.

$450,000

61%

Residential

12 months

The borrower is an inexperienced investor who operates a family business that does equine training. They were exercising a lease option to purchase from 2015 with a strike price of $619,000. The borrower paid $100,00 in cash in 2015 and amortized the balance to $450,000 through monthly lease payments. First Bridge Lending provided a loan for the borrower to finalize the purchase of the rental property.

The loan amount totaled $450,000 at 61% LTV for a 12-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure funding for their SFR purchase.

$640,000

71%

Residential

12 months

The borrowers are experienced flippers who own a construction company and have flipped over 10 homes in the last 36 months. First Bridge Lending refinanced their 4-bedroom, 3-bathroom SFR located in Fremont. These repeat borrowers originally purchased the property for $899,900 and are investing $105,000 in remodeling costs to resell for $1,295,000.

The loan amount totaled $640,000 at 71% LTV for a 12-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure funding for their latest flip property.

$700,000

61%

Residential

6 months

The borrower is an East Coast investor who was looking to buy their first California rental. First Bridge Lending provided financing to purchase the 4-bedroom, 3-bathroom SFR in Castro Valley, CA to save the deal when the borrower’s bank lender was no longer lending. The borrower purchased the property for $1,150,000 and will rent the upstairs for $3,500/month and the downstairs for $2,000/month.

The loan amount totaled $700,000 at 61% LTPP for a 6-month term. First Bridge Lending originator Christopher Carey facilitated this deal and helped the client secure funding for their SFR purchase.

$147,000

70%

Residential

12 months

The borrowers own four rental properties in Ukiah and were looking to add another to their portfolio. With a loan of $147,000 from First Bridge Lending, they purchased a 3-bedroom, 1-bathroom SFR in a typical Ukiah neighborhood for $210,000. They plan to invest $30,000 in remodeling, then lease the property for $1,750 per month.

The loan is 70% LTPP for a term of 12 months. First Bridge Lending Originator Louis Bardis facilitated this deal and helped the client secure funding for their latest rental property.

$240,000

65%

Residential

9 months

The borrowers, husband and wife, are an experienced home flipper team who successfully complete two to three projects per year. They purchased this 4-bedroom, 2.75-bathroom SFR in Rialto, CA for $370,000 with the help of a $240,000 loan from First Bridge Lending. The 2-story home is located on a corner lot in a mature, well-kept neighborhood. The borrowers plan to invest $30,000 for paint, minor upgrades, and landscaping, then re-sell for $450,000.

The loan is 65% LTPP for a term of 9 months. A First Bridge Lending originator facilitated this deal and helped the clients secure funding for their latest flip property.

$1,460,000

52%

Owner Occupied Bridge

12 months

The borrower was moving to San Clemente from Sunnyvale and owns 2 Bay Area rental properties. They were unable to qualify for a conventional loan due to their debt to income ratio. First Bridge Lending provided an owner occupied bridge loan, which allowed the borrower to access the equity in their current residence in order to purchase the new property. They will sell their current home to pay off the loan.

The loan amount totaled $1,460,000 at 52% LTV for a 12-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure funding to purchase their new home.

$1,162,000

70%

Residential

6 months

The borrower is an experienced full-time developer and flipper who own 2 commercial properties and has flipped 4 homes in the last 24 months. First Bridge Lending provided financing for the borrower to purchase the 3-bedroom and 1.5-bathroom SFR located in Redwood City, CA. The repeat borrower purchased the property for $1,660,000 and is investing $300,000 in remodeling costs to resell for $2,300,000.

The loan amount totaled $1,162,000 at 70% LTPP for a 6-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure funding for their latest flip property.

$2,615,000

58%

Residential

6 months

The borrower is a full-time real estate broker and flipper who does 2-3 flips each year. First Bridge Lending refinanced the 5-bedroom, 5-bathroom SFR in Los Altos, CA to pay off the borrower’s current lender while they put the house on the market. The borrower originally purchased the property for $3,900,000 and invested $600,000 in renovations and additional square footage.

The loan amount totaled $2,615,000 at 58% LTV for a 12-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure funding for their SFR refinance.

$1,075,000

31%

Commercial

12 months

The borrower is a physician who has owned the subject property just west of the 101 in Marin County since 2009. The property is zoned C3– Highway Commercial and was purchased for $1,495,000 in 2009. They have done $550,000 in improvements since then bringing the fee appraised value of the property to $3,500,000. Owner occupies 60% of the space with their medical offices while the remaining space is leased for the next 4 years to another medical office. First Bridge Lending was able to provide financing to pay off the borrower’s matured bank loan that was unable to be renewed.

The loan amount totaled $1,075,000 at 31% LTV for a 12-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure funding for their Commercial refinance.

$1,150,000

58%

Commercial

12 month

The borrower is a full-time real estate broker who has flipped more than 25 properties in the last 5 years and owns several multifamily properties. They have used First Bridge Lending for financing on many of their properties and sought them out again to refinance their most recent rental property.

The property is in a conforming downtown San Jose, CA neighborhood surrounded by Victorian homes and small residential properties. The borrower has obtained a use permit from the city to operate a single room occupancy business at the site. Our borrower purchased the property in 2013 $950,000 invested $400,000 in renovations.

The loan amount totaled $1,150,000 at 58% LTPP for a 12-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure funding for their latest rental property.

$536,250

55%

Commercial

12 months

The borrower is the President of an investment and planning firm primarily for commercial real estate. The property is 2,000 sq. ft. office space with 600 sq. ft. storage space zoned for light manufacturing with a ground level door. First Bridge Lending provided financing to payoff the borrower’s conventional loan.

The loan amount totaled $536,250 at 55% LTV for a 12-month term. A First Bridge Lending originator facilitated this deal and helped the client secure funding for their refinance on their commercial property.

$3,300,000

53%

Commercial

12 months

The borrowers are brothers in the medical and IT fields who invested in a commercial property to lease & rent out. First Bridge Lending refinanced the two-story mixed-use property with retail spaces on the first floor and residential space on the second floor located in downtown Mountain View, CA. The borrowers purchased the property in 2014 for $3,675,000 and invested $250,000 in upgrades. The property is fully occupied with a 3-5-year NNN leases with annual increases.

The loan amount totaled $3,300,000 at 53% LTV for a 12-month term. First Bridge Lending originator Christopher Carey facilitated this deal and helped the client secure funding for their refinance on their commercial property.

$8,435,000

60%

Commercial

12 months

The borrower is an experienced investor and landlord expanding their real estate portfolio. With a cross-collateral cash-out refinance loan from First Bridge Lending, the borrower received the required short-term capital to acquire another investment property. The loan was secured by three properties: a renovated 12-unit TIC in an average San Francisco neighborhood, and two 6-unit residential buildings that the borrower plans to renovate in the Mission District.

The loan amount totaled $8,435,000 at 60% LTV for a 12-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure funding for their next commercial investment property.

$1,200,000

48%

Commercial

12 months

The borrower is an experienced developer who is a project manager and landlord for the last 25 years. First Bridge Lending provided financing for the borrower’s cash-out refinance allowing the borrower to remodel the property adding 3,000 sq. ft. The property is retail space located on a busy street corner of an established residential area. In 2014 the borrower purchased the property for $2,015,000.

The loan amount totaled $1,200,000 at 48% LTV for a 12-month term. First Bridge Lending originator Christopher Carey facilitated this deal and helped the client secure funding for their commercial rental property.

$3,300,000

54%

Commercial

12 months

The borrower inherited the multifamily residential property they have managed for years. First Bridge Lending provided a refinance allowing the borrower to buy out the other owners. A property management company was hired to manage the units as the borrower has retired. The property is located on the edge of downtown St. Helena, CA and the market rents are expected to be $34,500/month.

The loan amount totaled $3,300,000 at 54% LTV for a 12-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure funding for their multifamily residential property.

$700,000

44%

Owner Occupied Bridge

12 months

The borrower inherited the property they live in and are listing it for sale. They turned to First Bridge Lending for an owner occupied bridge loan, which allowed the borrower to access the equity in their current residence in order to use the loan proceeds to purchase their new home out of state. The subject property is in good condition located in a nice rural subdivision.

The loan amount totaled $700,000 at 44% LTV for a 12-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure funding to purchase their new home.

$1,813,500

65%

Owner Occupied Bridge

12 months

The borrowers are a professor and security architect in the tech industry. Due to work environments moving to remote platforms the borrowers decided to relocate out of California. First Bridge Lending used the equity in their current home to provide a loan that will allow them to put a down payment on an out-of-state new home. They will sell their current home to pay off the loan.

The loan amount totaled $1,813,500 at 65% LTV for a 12-month term. A First Bridge Lending originator facilitated this deal and helped the client secure funding to purchase their new home.

$1,000,000

65%

Owner Occupied Bridge

12 months

The borrowers are in the medical field and looking to purchase their next home. First Bridge Lending provided financing on the purchase of their new home while their current residence was listed for sale. The owner occupied bridge loan allowed the borrowers to purchase their new residence without the contingency of their current house selling. They will sell their current home to pay off the loan.

The loan amount totaled $1,000,000 at 65% LTPP for a 12-month term. First Bridge Lending originator Christopher Carey facilitated this deal and helped the client secure funding to purchase their new home.

$1,200,000

65%

Owner Occupied Bridge

6 month

The borrower is in finance and choosing to relocate due to the recent shift to remote work. First Bridge Lending provided an owner occupied bridge loan, which allowed the borrower to access the equity in their current residence for the down payment on their out-of-state purchase of their new home. The subject property had extensive renovations along with construction of a new ADU. They will sell their current home to pay off the loan.

The loan amount totaled $1,200,000 at 65% LTV for a 6-month term. A First Bridge Lending originator facilitated this deal and helped the client secure funding to purchase their new home.

$780,000

50%

Owner Occupied Bridge

12 months

The borrowers wanted to purchase a custom-built 3-bedroom, 2.5-bathroom home on 5 acres in Redding, CA, but needed time to sell their current 2-bedroom, 1-bathroom home in Redwood City. First Bridge Lending provided a bridge loan that allowed the borrowers to purchase their dream home quickly in the fast-paced California housing market without first selling their current residence. The borrowers could then take their time putting their current home on the market, increasing the likelihood of receiving a higher offer.

The loan amount totaled $780,000 at 50% LTV for a 12-month term. The sale of the current residence will fully pay off the loan. First Bridge Lending originator Brian Haines facilitated this deal and helped the client secure funding to purchase their new home.

$600,000

24%

Commercial

24 months

The borrower is a full-time real estate investor with some commercial experience who was looking to purchase a commercial property in the North Highlands neighborhood of Sacramento, CA. First Bridge Lending provided a short-term loan for the investor to acquire the subject property, which is a retail building at 70% occupancy that features a variety of small stores. The borrower planned to invest $100,000 in renovations to improve the property and then keep it as part of their diversified rental portfolio.

The loan amount totaled $600,000 at 24% LTPP for a 24-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure funding to purchase the retail property.

$390,000

60%

Residential

6 months

The borrower is an experienced investor interested in purchasing another rental property in Truckee, CA. They came to First Bridge Lending seeking financing for a 2-story corner unit in a 4-unit HOA behind the Tahoe Donner ski area. The seller received a higher offer but chose this one because of how quickly FBL could provide funding. The 3-bedroom, 2-bathroom property features upgraded floors, paint, appliances, kitchen, and fireplace, and will continue the borrower’s 20+ years of experience owning Tahoe rental properties.

The loan amount totaled $390,000 at 60% LTPP for a 6-month term. First Bridge Lending originator Christopher Carey facilitated this deal and helped the client secure fast funding to purchase the property.

$200,000

13%

Residential

9 months

The borrowers are in the financial industry and interior design industry while flipping houses part-time. They purchased the subject property for $1,172,000 in 2021 and have spent $400,000 on renovations. First Bridge Lending refinanced the 2,039 sq ft SFR with 3-bedrooms and 2-bathrooms located in Sonoma, CA; allowing the borrowers to use equity from the property to recoup rehab expenses while the property is listed.

The loan amount totaled $200,000 at 13% LTV for a 9-month term. First Bridge Lending originator Christopher Carey facilitated this deal and helped the client secure funding on their latest flip.

$5,775,000

55%

Commercial

24 months

The borrower is an experienced developers expanding their commercial real estate portfolio. First Bridge Lending provided a loan for the developers to acquire the subject property, which is a service oriented multi-tenant retail center located on a high-traffic corner in the Kearny Mesa submarket of San Diego. Kearny Mesa has maintained a sub-5% vacancy level in neighborhood retail centers over the past decade. The property was cash flowing and being acquired at a 5% cap rate on in-place rents. The subject was 84% occupied and the in-place rents were below market creating an opportunity for the borrower to implement a more professional operational plan for the asset.

The loan amount totaled $5,775,000 at 55% LTPP for a 24-month term. First Bridge Lending originator Brian Haines facilitated this deal and helped the client secure funding for their next commercial investment property.

$2,418,900

65%

Owner Occupied Bridge

12 months

The borrowers were retired following the sale of a manufacturing business and were relocating to California from Nevada. First Bridge Lending was able to provide a stand-alone owner-occupied bridge loan for the borrowers to purchase their new residence in California. The subject property is a luxury home in a small subdivision with ocean views and within walking distance to the beach. The owner-occupied bridge loan allowed the borrowers to purchase their new residence without the contingency of their current house selling. They will sell their current home to pay off the loan.

The loan amount totaled $2,418,900 at 65% LTPP for a 12-month term. First Bridge Lending originator Brian Haines facilitated this deal and helped the clients secure funding to purchase their new home.

$945,000

72%

Residential

12 months

The borrower is a real estate broker and investor who has experience flipping houses. They came to First Bridge Lending to finance the acquisition of their next fix and flip property. The subject property is 1,678 sq ft SFR with 4-bedrooms and 2-bathrooms, located in a nice neighborhood in Studio City, CA. The borrower plans to invest $185,000 in remodeling, then re-sell for $1,850,000.

The loan amount totaled $945,000 at 72% LTPP for a 12-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the clients secure funding for their SFR purchase.

$1,500,000

52%

Residential

12 months

The borrower is retired from the financial services industry but still involved in the community of Sonoma County. First Bridge Lending provided a refinance allowing the borrower to fix up the property and have extra liquidity through the selling process. The property is a 2,584 sq ft 3-bedroom and 3-bathroom SFR with a pool and 3-car garage on 8.93 acres. It will be listed for $2,899,000.

The loan amount totaled $1,500,000 at 52% LTV for a 12-month term. First Bridge Lending originator Louis Bardis facilitated this deal and provided financing to help the client prepare the property to put on the market.

$700,000

63%

Residential

12 months

The borrower is a manager of an asset management company and was looking to purchase another investment property. They came to First Bridge Lending to use the equity in their current rental property to finance their new acquisition. Purchased in 2018, the subject property is a 1,211 sq ft condominium with 2-bedrooms and 2-bathrooms. It is in a community close to amenities and is currently leased.

The loan amount totaled $700,000 at 63% LTV for a 12-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure funding to purchase their next investment property.

$542,000

51%

Residential

18 months

The borrowers are real estate brokers and engineers who own multiple properties, including vacation rentals. They came to First Bridge Lending to finance the purchase of their next vacation rental property to expand their portfolio. The 4,389 sq ft mountain style SFR with 5-bedrooms and 3-bathrooms is located on 7 acres in a semi-rural neighborhood south of Bass Lake. The borrowers plan to do light remodeling before relisting the property as a vacation rental.

The loan amount totaled $542,000 at 51% LTPP for an 18-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure funding to purchase their next investment property.

$1,540,000

37%

Owner Occupied Bridge

12 months

The borrower is a principle at a marketing firm and was looking to downsize. First Bridge Lending provided an owner occupied bridge loan, which allowed the borrower to access the equity in their current 4-bedroom 3-bathroom residence in San Francisco, CA to purchase their new 3-bedroom 2-bathroom home in Pacifica, CA. They have their current residence listed and the sale of their current home will pay off the loan.

The loan amount totaled $1,540,000 at 37% LTV for a 12-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure funding to purchase their new home.

$1,125,000

59%

Owner Occupied Bridge

12 months

One borrower works in the school district and the other borrower is retired. Borrowers are moving to downsize. First Bridge Lending provided an owner occupied bridge loan, which allowed the borrower to access the equity in their current 4,485 sq. ft. residence on 1.06 acres in El Dorado Hills, CA to purchase their new 2,351 sq. ft. home on .48 acres in El Dorado Hills, CA. They will list their current residence and the sale will pay off the loan.

The loan amount totaled $1,125,000 at 59% LTV for a 12-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure funding to purchase their new home.

$1,450,000

57%

Owner Occupied Bridge

12 months

The borrowers are retired and selling their current CA residence to move out of state. A stand alone owner occupied bridge loan from First Bridge Lending allowed the borrowers to access the equity in their current home to pay cash for a new out of state primary residence. Their current home is 4-bedroom and 2-bathroom SFR located in the Eagle Rock area east of Glendale in Los Angeles, CA. The sale of the Los Angeles, CA SFR will payoff the loan.

The loan amount totaled $1,450,000 at 57% LTV for a 12-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure funding to purchase their new home.

$1,290,000

60%

Commercial

18 months

The borrower owns an auto business that operates in an industrial warehouse building. The landlord of the building has offered to sell the property to the borrower off market. First Bridge Lending provided them with financing to purchase the 10,000 sq ft single-story metal over steel frame warehouse building. There are two interior buildouts which each include a small office and restroom area. The balance of the space is improved as warehouse with 18’ clear heights. The building includes a wet fire suppression system and is equipped with five 12’ x 14’ metal overhead roll-up doors. A Phase 1 was performed and reported no recognized environmental concerns.

The loan amount totaled $1,290,000 at 60% LTPP for an 18-month term. First Bridge Lending originator Brian Haines facilitated this deal and helped the client secure financing for their commercial property purchase.

$4,320,000

58%

Commercial

18 months

The borrowers are real estate investors with experience owning and operating commercial real estate. First Bridge Lending provided financing to help the borrowers purchase the industrial property consisting of 4 separate buildings and 1 commercial billboard situated on 1.156 acres and 27,000 sq ft of yard space. The borrowers have various upgrades planned and have pre-leased 3 of the buildings. They will raze the 4th structure and ground lease the corner parcel.

The loan amount totaled $4,320,000 at 64% LTPP for an 18-month term. First Bridge Lending originator Brian Haines facilitated this deal and helped the client secure funding for their commercial property purchase.

$950,000

50%

Commercial

12 months

The borrowers are business owners and have been in the luxury auto business for over a decade. First Bridge Lending provided them with financing to purchase a commercial property, permitted for auto-dismantling. The property is 2 contiguous parcels totaling over 3 acres, including a 5,000 sq ft warehouse with a 16 ft high roll up door and an 800 sq ft office. Property has clean Phase 1. The borrowers plan to use cash flow from their businesses to gradually pay off the loan.

The loan amount totaled $950,000 at 50% LTPP for a 12-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure funding for their commercial property purchase.

$273,000

70%

Residential

6 months

The borrower has been a real estate agent and investor for nearly 20 years. They have invested in 3 fix and flips in the last 12 months and own a rental property. They came to First Bridge Lending to finance the purchase of their fix and flip property to expand their portfolio. The borrower plans to invest $50,000 into the 4-bedrooms and 3.5-bathrooms 2,499 sq ft SFR. After completing the cosmetic upgrades, the borrower will list it for sale to make a profit.

The loan amount totaled $273,000 at 70% LTPP for a 6-month term. First Bridge Lending originator Roxanna Amaya facilitated this deal and helped the client secure funding to purchase their next investment property.

$835,000

56%

Owner Occupied Bridge

12 months

The borrower is retired and owns their current residence and a rental property free and clear. First Bridge Lending provided an owner-occupied bridge loan, which allowed the borrower to access the equity in their current Condo in Morgan Hill, CA to purchase their new 2-bedroom 2-bathroom SFR located in a Morgan Hill retirement community. The borrower was able to list their current residence for sale and take time to consider since they already secured their new residence with the First Bridge Lending bridge loan.

The loan amount totaled $835,000 at 56% LTV for a 12-month term. First Bridge Lending originator Brian Haines facilitated this deal and helped the client secure funding to purchase their new home.

$160,000

23%

Residential

12 months

The borrower owns a custom apparel company and invests in real estate. First Bridge Lending provided a loan using the equity in their current rental property in Vallejo, CA to finance their new out-of-state acquisition. The rental property is a 2-story SFR that has 6 separate living units that are all currently leased.

The loan amount totaled $160,000 at 23% LTV for a 12-month term. First Bridge Lending originator Christopher Carey facilitated this deal and helped the client secure funding to refinance their investment property.

$2,762,500

65%

Residential

12 months

The borrower owns a cyber security business with offices in Texas & California and they own several SFR’s free and clear. They came to First Bridge Lending to finance the purchase of their next investment property in San Carlos, CA. The property is a 2-story SFR with 4 bedrooms and 3 bathrooms on a hillside cul-de-sac. It is in excellent condition and has a flat backyard with views of Hayward Hills and the San Francisco Bay. The borrower plans to rent the home short-term and will refinance First Bridge Lending’s loan with a conventional lender.

The loan amount totaled $2,762,500 at 65% LTPP for a 12-month term. First Bridge Lending originator Louis Bardis facilitated this deal and helped the client secure funding to purchase their next investment property.